[ad_1]

Bitcoin and Ethereum witnessed yet another phase of short liquidations, bringing bullish momentum to the assets.

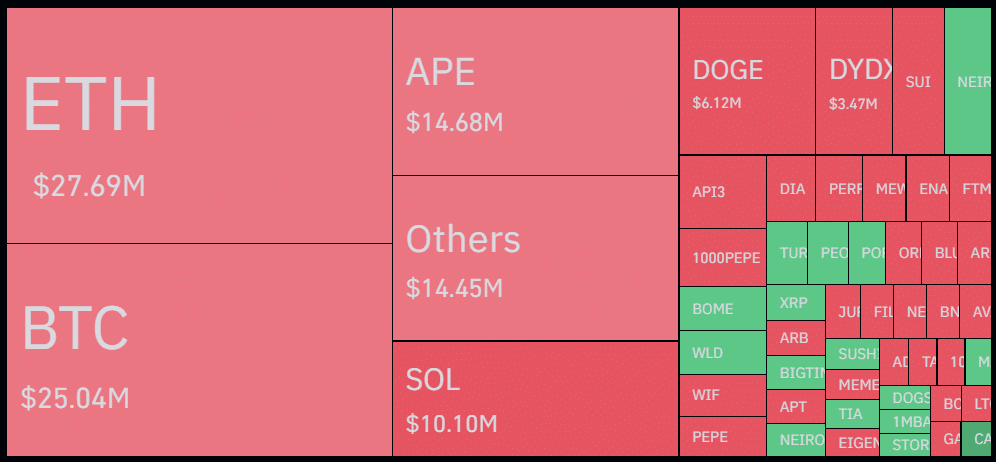

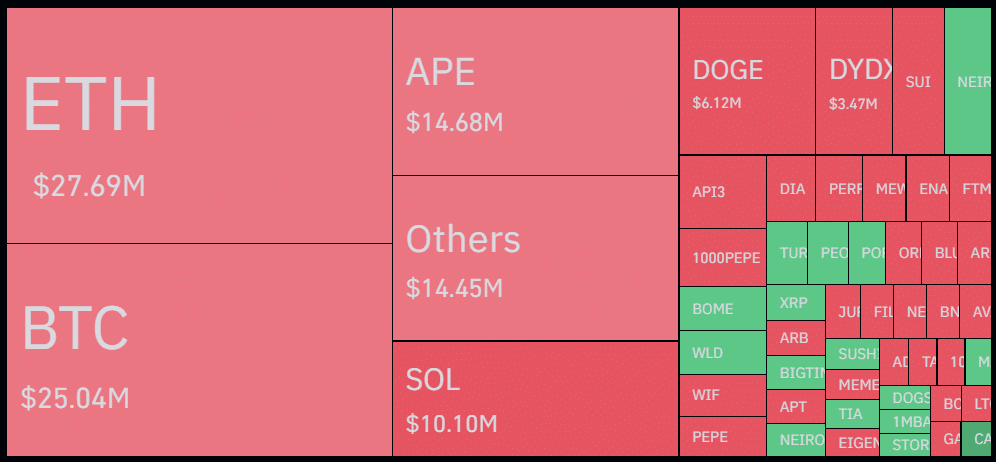

According to data provided by Coinglass, the total crypto liquidations reached $138.23 million as bullish sentiment dominates the market. Of this tally, over $95 million has been liquidated from short trading positions, showing a 71% dominance over long positions.

Increased short liquidations usually create buying pressure.

Ethereum (ETH) is leading the chart with $27.69 million in liquidations—$23.84 million shorts and $3.85 million longs. ETH gained 3.1% in the past 24 hours and is trading at $2,730 at the time of writing.

Its daily trading volume rallied by 117%, reaching $17.4 billion, as investors interest increases.

Notably, the largest single liquidation order was executed on Binance, the largest crypto exchange by trading volume, and was worth $6.64 million in the ETH/USDT pair.

Bitcoin (BTC) takes the second spot with $25 million in liquidations—$21 million shorts and $4 million longs. This caused the BTC price to reach a four-month high of $69,460 earlier today. Despite the latest correction, Bitcoin is still up 0.45% over the past day and is changing hands at $68,700 at the reporting time.

The flagship crypto asset saw a 74% surge in its daily trading volume, currently at $24 billion.

The global crypto market cap has also reached a three-month high of $2.49 trillion as the majority of the leading alt-coins record bullish gains, according to data from CoinGecko.

If long positions start to liquidate, it could potentially create significant selling pressure as traders would try to minimize their losses.

[ad_2]

Source link