[ad_1]

Uniswap price rose for five consecutive days as crypto analysts predicted further upside potential.

The Uniswap (UNI) token reached $12.37 on Monday, Nov. 25, marking its highest level since April 1. This represents a gain of over 150% from its lowest point this year.

In an X post, Anasta Maverick, a popular cryptocurrency influencer with over 26,000 followers, predicted the coin could rise to $17.70, a 50% increase from its current level.

Meanwhile, HypeManAlex, a crypto analyst with over 54,000 followers, estimated a possible surge to $100, a 733% jump. He highlighted Uniswap’s prominence in the decentralized exchange industry as a key factor.

Data reveals that Uniswap supports over 20 chains, with a trading volume of over $26 billion in the past seven days. Since its launch, the platform has processed more than $1.54 trillion, including $81.7 billion in the last 30 days

Its biggest competitor, Raydium, handled $26.86 billion in the past week and $231 billion cumulatively

The network has also introduced Unichain, a layer-2 solution currently in its testnet phase, with the public mainnet expected by late 2024 or early 2025. Unichain aims to provide a better alternative to Ethereum, Solana, and Arbitrum.

However, the risk that Uniswap price faces is that whales have continued to sell the coin. Data on Etherscan shows that one whale moved over 466,000 UNI tokens worth $5.4 million to OKX, an important step of selling it. Another whale moved tokens worth $1.29 million to Coinbase.

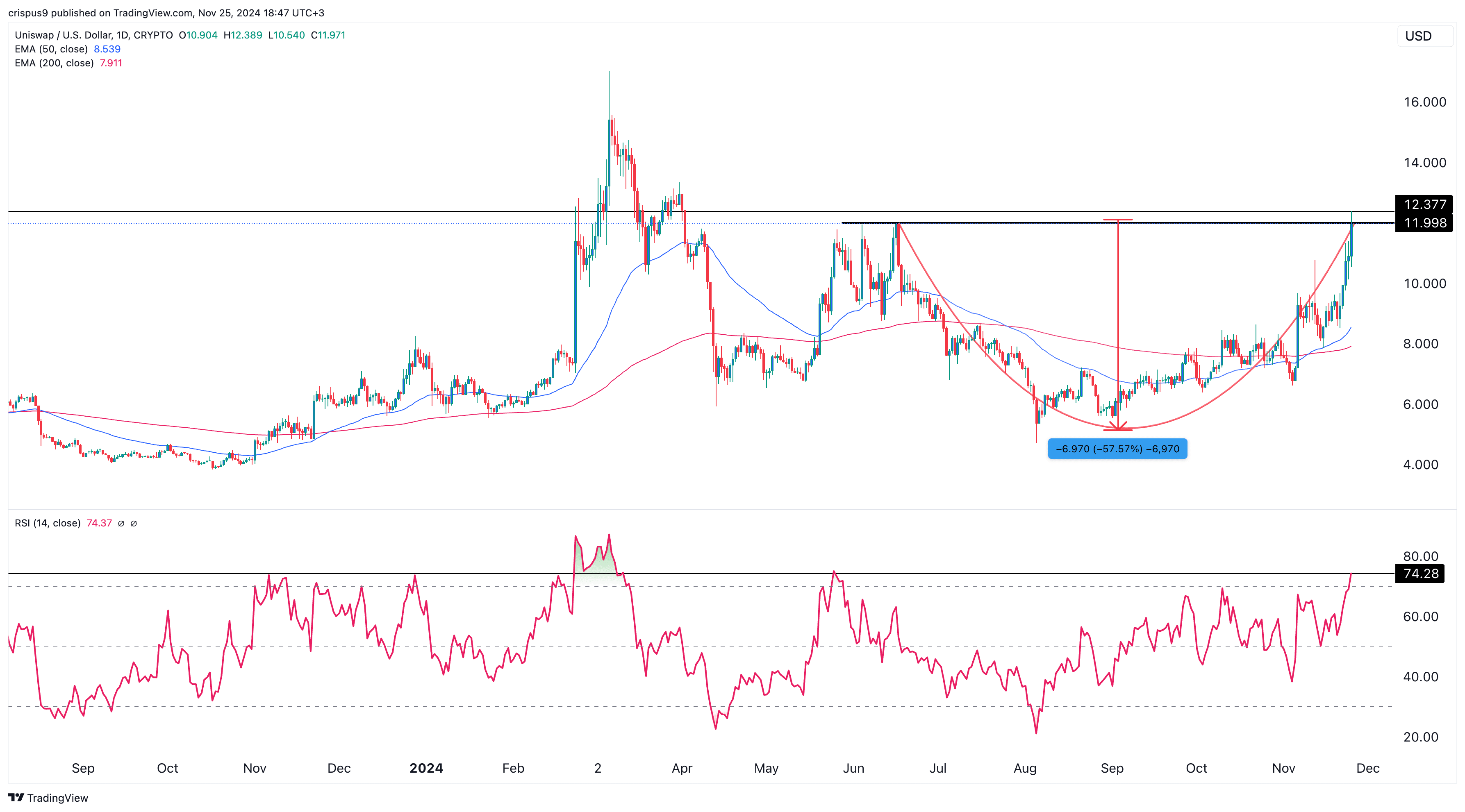

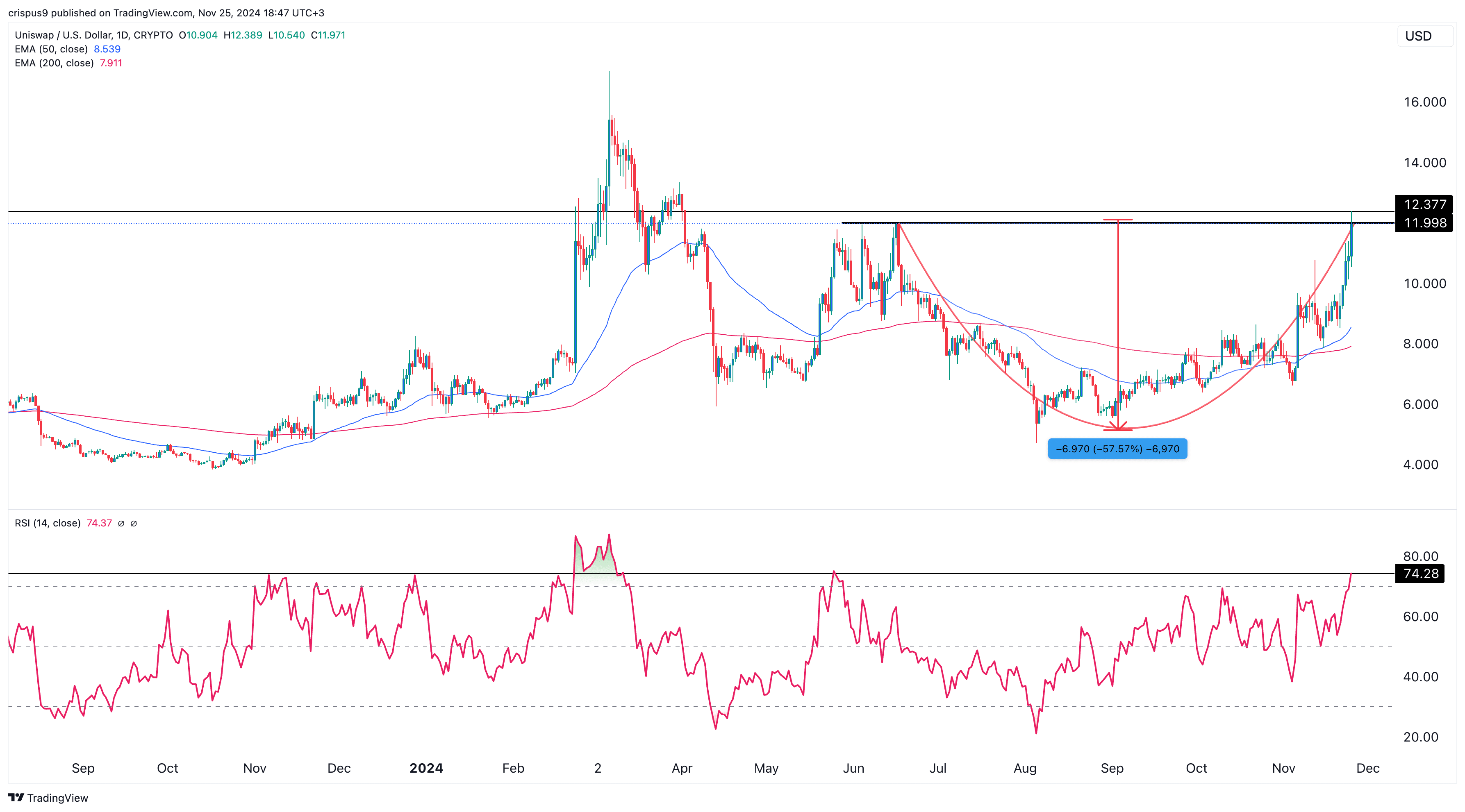

Uniswap price analysis

The daily chart indicates that UNI has formed a golden cross pattern as the 50-day and 200-day Exponential Moving Averages crossed each other.

A cup and handle pattern, characterized by a rounded bottom followed by consolidation, is also evident. This pattern suggests a potential bounce to $17 in the near term.

However, a rise to $100 in 2024 appears unlikely, as it would require a 733% increase from the current level. A drop below the $9 support level would invalidate the bullish outlook.

[ad_2]

Source link