[ad_1]

- Bitcoin dominance has surged to new heights, indicating a bullish market sentiment.

- Yet, dwindling new investor interest may impede this upward trajectory.

Bitcoin [BTC] dominance has surged to a new high, nearing 57% of the total market share against altcoins. This rise aligns with BTC’s renewed momentum as it breaks past the $64K mark, now trading at $64,400.

This price range gains significance due to its similarity to the late August rally, when bearish pressure drove BTC down below $55K in just two weeks.

Thus, this level now represents a key battleground, with the potential to determine BTC’s next big move.

Bitcoin dominance does not guarantee a rebound

Essentially, Bitcoin dominance shows BTC’s share in the overall crypto market.

As the first and largest cryptocurrency by market cap, BTC maintains a leading position, and traders closely watch its dominance as an indicator of market sentiment.

Currently, the outlook is optimistic, with a significant portion of stakeholders moving out of net loss positions. However, for a breakout to materialize, these investors must avoid offloading their positions.

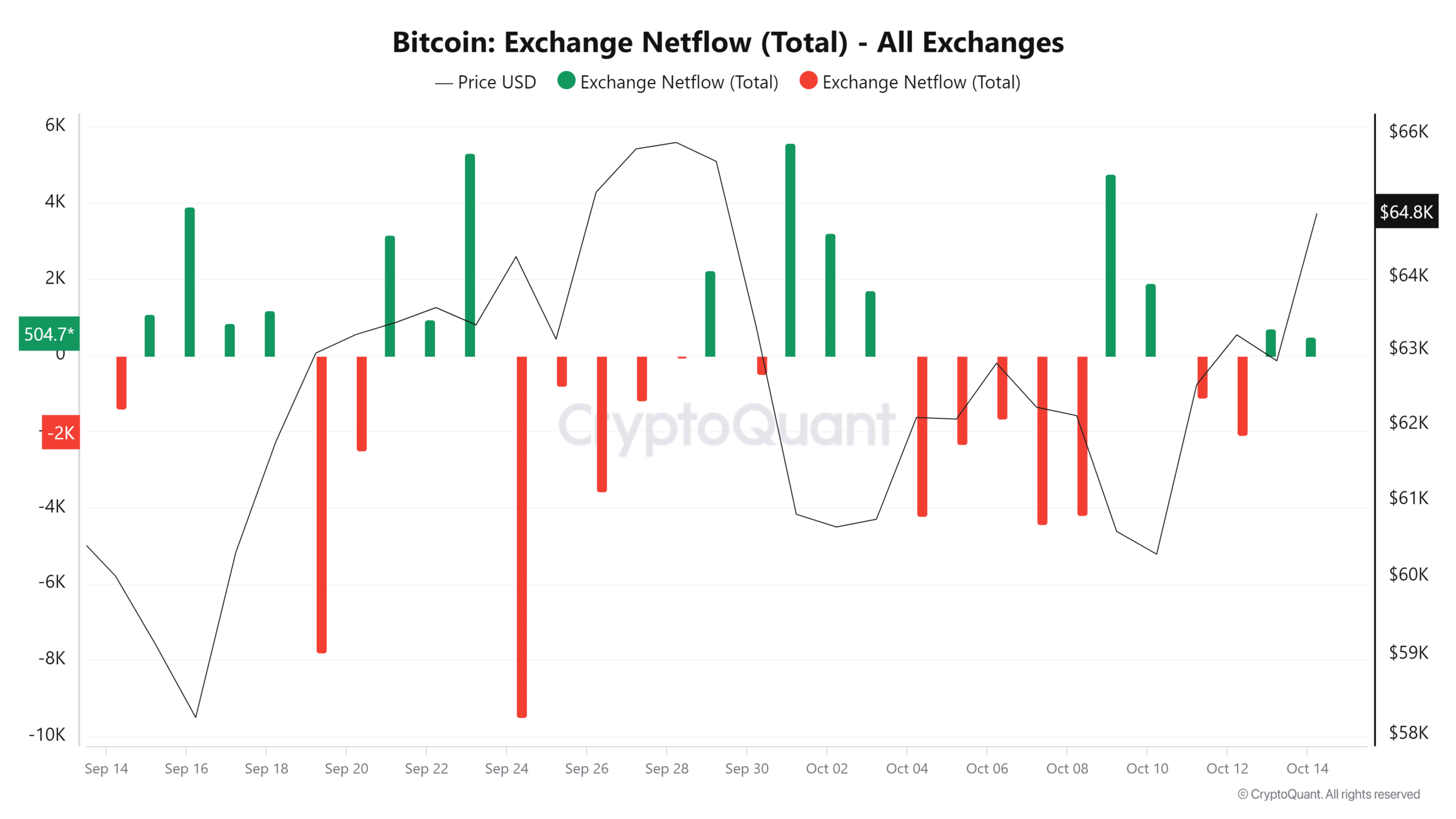

Historically, a surge in Bitcoin deposits to exchanges has coincided with daily price lows. If traders don’t view the current price as a “dip,” the anticipated rise to $66K may falter.

Additionally, what’s more concerning is the lack of new investors entering the market despite high Bitcoin dominance. This lack of fresh capital could limit BTC from achieving its next price target.

If this trend doesn’t reverse in the next day or two, Bitcoin might be facing a correction that could pull it back to $62K.

In short, the current $64K level hasn’t yet flipped to support, indicating uncertainty among investors about entering the market at this price. Many may be waiting for a retracement to buy when BTC reaches a local low.

Another retracement may become necessary

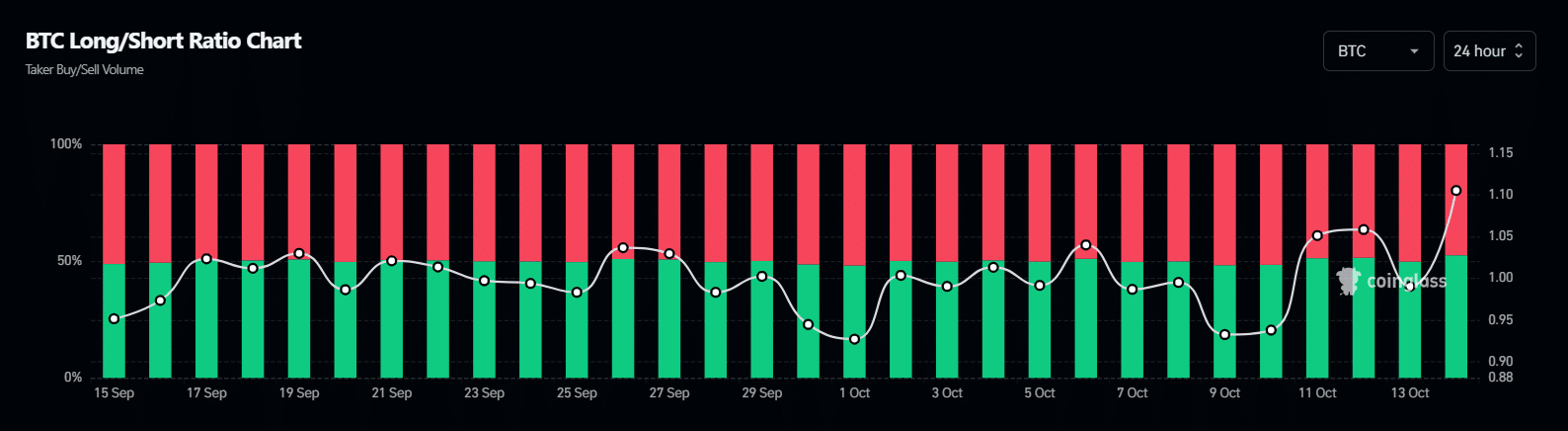

In its effort to repeat the late July rally when BTC closed near $66K, Bitcoin dominance has faltered three times since then, primarily driven by speculative traders.

For instance, during the late September cycle, when BTC nearly reached its price target, excessive shorting led to a pullback as long positions were forced to sell their holdings.

Currently, a majority of future traders are betting on a rebound, as evidenced by the spike in the red zone.

However, caution is warranted, as spot market traders do not share the same bullish outlook for BTC as those in the derivatives market.

This divergence may be exploited by short sellers, who are likely to increase their positions, capitalizing on the lack of fresh capital entering the market.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Therefore, alongside high Bitcoin dominance, converting the $64K level into support is crucial. This can occur if new buyers view the current price as an opportunity to buy the dip.

Conversely, if they hesitate, a retracement to the $62K–$64K range may be necessary for a healthy shakeout before BTC can break above $66K.

[ad_2]

Source link