[ad_1]

Key takeaways:

- Our Algorand price prediction indicates a high of $0.167 by the end of 2024.

- In 2025, it will range between $0.1201 and $0.2587, with an average price of $0.2401.

- In 2030, it will range between $1.50 and $1.76, with an average price of $1.67.

Algorand’s capabilities make it an interesting prospect for investors and developers interested in smart contracts and blockchain interoperability. A 2019 video featured Gary Gensler, Securities and Exchange Commission chair, referring to Algorand as a great technology and using it as an example when discussing the decentralization of cryptocurrencies.

Will ALGO go up? Can it reach $10? Where will ALGO be in 5 years? We explore these and more in our Cryptopolitan price prediction.

Overview

| Cryptocurrency | Algorand |

| Ticker | ALGO |

| Market cap | $957.15M |

| Trading volume | $17.69M |

| Circulating supply | 8.33B |

| All-time high | $3.28 on Jun 21, 2019 |

| All-time low | $0.08761 on Sep 11, 2023 |

| 24-hour high | $0.1168 |

| 24-hour low | $0.1133 |

Algorand price prediction: Technical analysis

| Metric | Value |

| Volatility (30-day variation) | 4.99% |

| 50-day SMA | $0.1269 |

| 200-day SMA | $0.1513 |

| Sentiment | Bearish |

| Fear and greed index | 69 (Greed) |

| Green days | 12/30 (40%) |

ALGO price analysis

As of October 28, ALGO’s price rose by 0.45% in 24 hours. The cryptocurrency has a market capitalization of $956.07M and a trading volume of $17.69M, which has dropped by 9.78%.

Algorand’s bearish signals

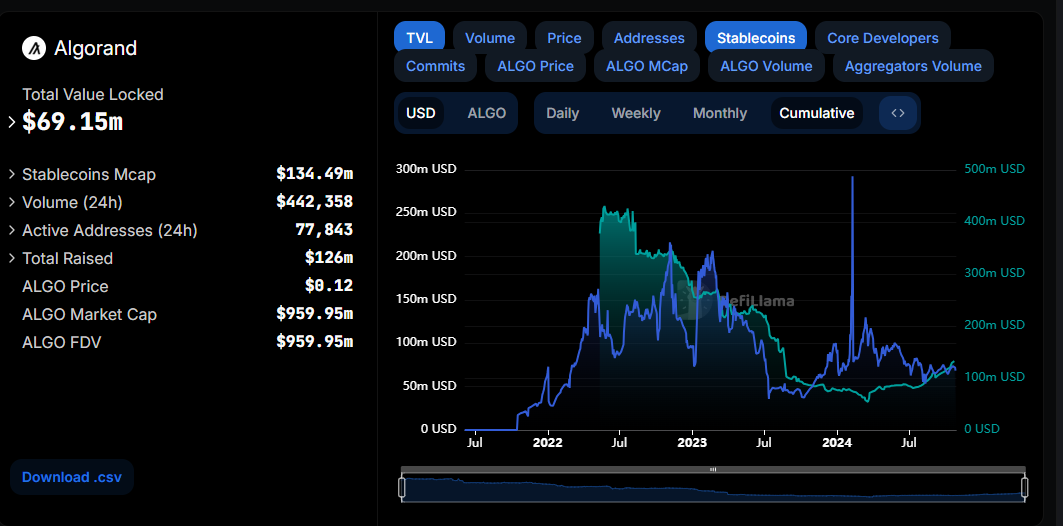

Algorand TVL and Stablecoin market cap. Image source: DefiLlama

Algorand’s total value locked (TVL) has gradually dropped since March and now stands at $69.15 million. TVL is the amount of funds locked up by an ecosystem’s decentralized applications. A drop in TVL suggests that users are withdrawing their assets from the protocol as interest wanes.

On the contrary, the protocol’s stablecoin market cap rose over the same period from a low of $109.91 million to $134.49 million at press time. The statistics point to growing user interest in the protocol’s stablecoins, which provide stability in a highly volatile market.

Algorand open interest. Image source: Coinglass

Open interest and active positions in the derivative market have moved in tandem with the price over the last five months. When both drop, they signal that traders with long positions exit the market. This often occurs in bearish markets, indicating a lack of new money entering the market and a potential bearish continuation.

ALGO/USD 1-day chart analysis

ALGO/USD 1-day chart. Image source: TradingView

The daily ALGO chart highlights its drop from the third quarter of 2024 after it reached a high of $0.26. At first, the drop was drastic, then slowed from May and began recovering in September, but dropped again into October. The William Alligator is feeding as ALGO volatility rises. The relative strength index is 39.26 in neutral territory, while the MACD indicators show negative market momentum.

ALGO technical indicators: Levels and action

Daily simple moving average (SMA)

| Period | Value ($) | Action |

| SMA 3 | 0.1160 | SELL |

| SMA 5 | 0.1190 | SELL |

| SMA 10 | 0.1206 | SELL |

| SMA 21 | 0.1232 | SELL |

| SMA 50 | 0.1269 | SELL |

| SMA 100 | 0.1277 | SELL |

| SMA 200 | 0.1513 | SELL |

Daily exponential moving average (EMA)

| Period | Value ($) | Action |

| EMA 3 | 0.1209 | SELL |

| EMA 5 | 0.1214 | SELL |

| EMA 10 | 0.1228 | SELL |

| EMA 21 | 0.1243 | SELL |

| EMA 50 | 0.1271 | SELL |

| EMA 100 | 0.1337 | SELL |

| EMA 200 | 0.1471 | SELL |

What to expect from ALGO price analysis next?

Per our technical indicators, ALGO’s price trend is bearish, and the fear and greed index shows greed among investors as it registered more red days in the last 30. Data analysis, however, shows declining activity in decentralized finance applications but a growing demand for its stable coins.

Why is ALGO down?

ALGO has registered negative momentum this month. This move comes as ALGO seeks support amidst a dropping TVL.

Will ALGO recover?

ALGO is dropping over the short term; however, the move is gradual. The general trend remains bearish as it seeks support.

Will ALGO reach $0.15?

ALGO’s immediate resistance level stands at $0.15. With the positive market momentum rising, a breakout is highly probable.

Will ALGO reach $10?

Per our Cryptopolitan price prediction, it remains highly unlikely for ALGO to break above $10 in the period ending 2030.

Will ALGO reach $100?

At $100, Algorand market capitalization has to rise above $700 billion from the current $1.2 billion. In comparison, Ethereum’s market capitalization is at $400 billion. Per our price prediction, Algorancd is highly unlikely to reach $100.

Does ALGO have a good long-term future?

Like most mega-altcoins, Algorand is trading at its lowest level this year. A break below 30 RSI will be crucial to sending it to previous highs. Looking ahead, ALGO will register new all-time highs in the coming years.

Is ALGO a good investment?

Analysis by Intotheblock shows that 95% of holders are at a loss at the current price. The figure will likely drop lower in the short term. However, as our Cryptopolitan price prediction shows, this will change over the long term.

Recent news

The Country Head of Nigeria at the Algorand Foundation, Benjamin Onuoha, has reiterated Algorand’s dedication to supporting digital literacy and expertise. In his statement, Onouha highlighted Algorand’s impact in 2023, where the top 3 Nigerian startups received up to $95,000 in cash prizes and Amazon infrastructure credits.

ALGO price predictions October 2024

The Algorand price forecast for October is a maximum price of $0.128 and a minimum price of $0.138. The average price for the month will be $0.142.

| Month | Potential low ($) | Potential average ($) | Potential high ($) |

| October | 0.128 | 0.138 | 0.142 |

Algorand price prediction 2024

For the second half of 2024, ALGO’s price will range between $0.1140 and $0.1671. The average price for the period will be $0.1544.

| Year | Potential low ($) | Potential average ($) | Potential high ($) |

| 2024 | 0.114 | 0.154 | 0.167 |

Algorand price prediction 2025 – 2030

| Year | Potential low ($) | Potential average ($) | Potential high ($) |

| 2025 | 0.1994 | 0.2052 | 0.2414 |

| 2026 | 0.2928 | 0.3010 | 0.3446 |

| 2027 | 0.4353 | 0.4503 | 0.5043 |

| 2028 | 0.6130 | 0.6355 | 0.7556 |

| 2029 | 0.9281 | 0.9599 | 1.06 |

| 2030 | 1.33 | 1.37 | 1.58 |

Algorand price prediction 2025

The ALGO price forecast for 2025 is a high of $0.2414. It will reach a minimum price of $0.1994 and average at $0.2052.

Algorand price prediction 2026

The year 2026 will experience more bullish momentum. Our Algorand price prediction estimates it will range between $0.2928 and $0.3446, with an average price of $0.3010.

Algorand price prediction 2027

Algorand’s price prediction climbs even higher into 2027. According to the prediction, ALGO’s price will range between $0.4353 and $0.5043, with an average price of $0.4503.

Algorand price prediction 2028

Our analysis indicates a further acceleration in ALGO’s price. It will trade between $0.6130 and $0.7556, with an average price of $0.6355.

Algorand price prediction 2029

According to the ALGO price prediction for 2029, the price of ALGO will range from $0.9281 to $1.06, with an average price of $0.9599.

ALGO price prediction 2030

The ALGO price prediction for 2030 indicates the price will range between $1.33 and $1.58. The average price of ALGO will be $1.37.

Algorand market price prediction: Analyst’s ALGO price forecast

| Platform | 2024 | 2025 | 2026 |

| Digitalcoinprice | $0.26 | $0.29 | $0.45 |

| Changelly | $0.14 | $0.30 | $0.31 |

| Gate.io | $0.16 | $0.18 | $0.18 |

Cryptopolitan’s Algorand price prediction

Our predictions show that ALGO will achieve a high of $0.1948 in the second half of 2024. In 2025, it will range between $0.2101 and $0.2587, with an average of $0.2401. In 2030, it will range between $1.50 and $1.76, with an average price of $1.54. Note the predictions are not investment advice. Seek independent professional consultation or do your research.

Algorand historic price sentiment

- Algorand held its token sale in June 2019 at $2.4 each.

- Union Square Ventures, Lemniscap, and NGC Ventures, among others, held earlier funding rounds. The public sale raised $60.40 million while funding rounds raised $66 million.

- Token sale participants who held their tokens since launch are down 90%.

- Binance listed ALGO on 21 June 2019. According to Coinmarketcap data, it pumped after the listing to reach its all-time high (ATH) at $3.28.

- ALGO later crashed; four months later, it was down 90% from ATH.

- In July 2021, Coinbase listed ALGO. As a result, it gradually recovered and peaked at $0.637 in August.

- In retrospect, 2021 was the golden year for the crypto market. The emergence of NFTs, DeFi growth, and institutional interest drove growth.

- So, in 2021, it rose from a low of $0.32 in January to $2.3 in October, a 200% gain.

- Nothing prepared crypto enthusiasts for the 2023 crypto winter, which worsened with the FTX crash. The year closed with ALGO trading at $0.23.

- The decline continued through 2023, registering an all-time low at $0.0876 in September.

- Market recovery began in October. By the end of the year, it had risen above $0.2. It now trades at $0.13.

[ad_2]

Source link