[ad_1]

On-chain data shows a significant decline in the Bitcoin large holder outflows as the flagship cryptocurrency remains above the $68,000 mark.

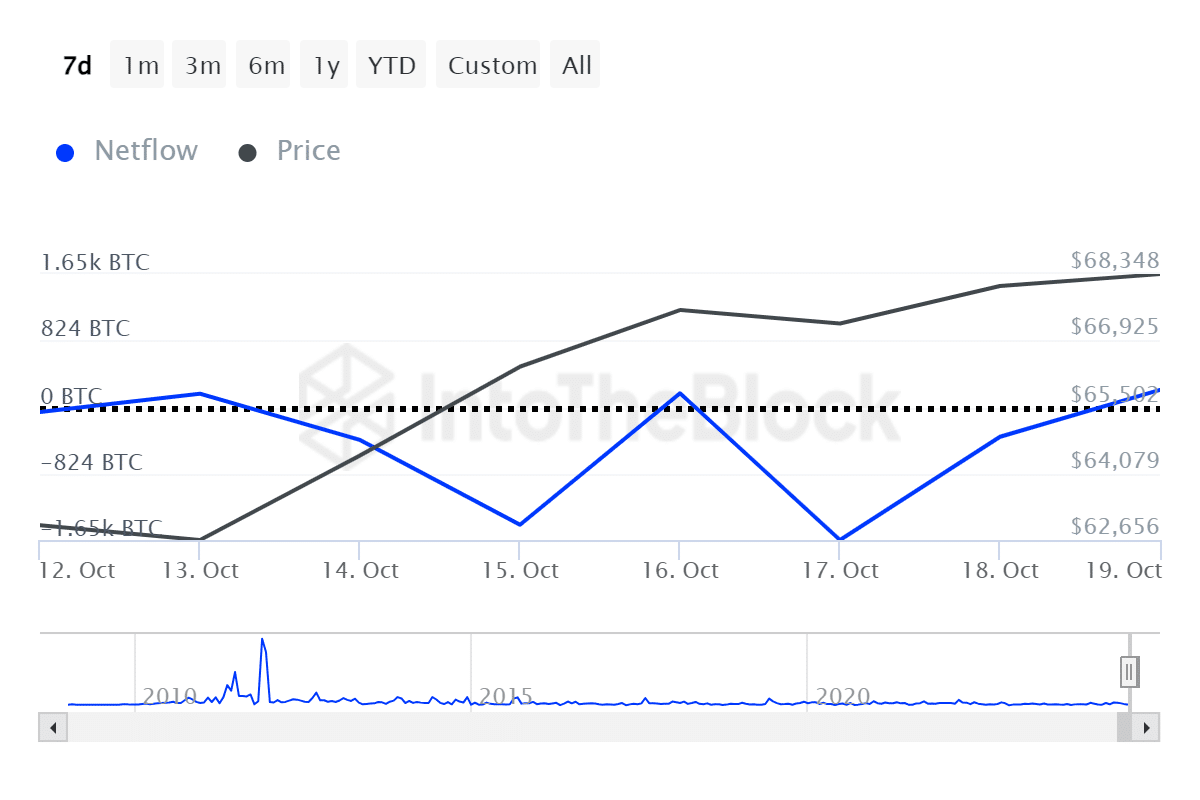

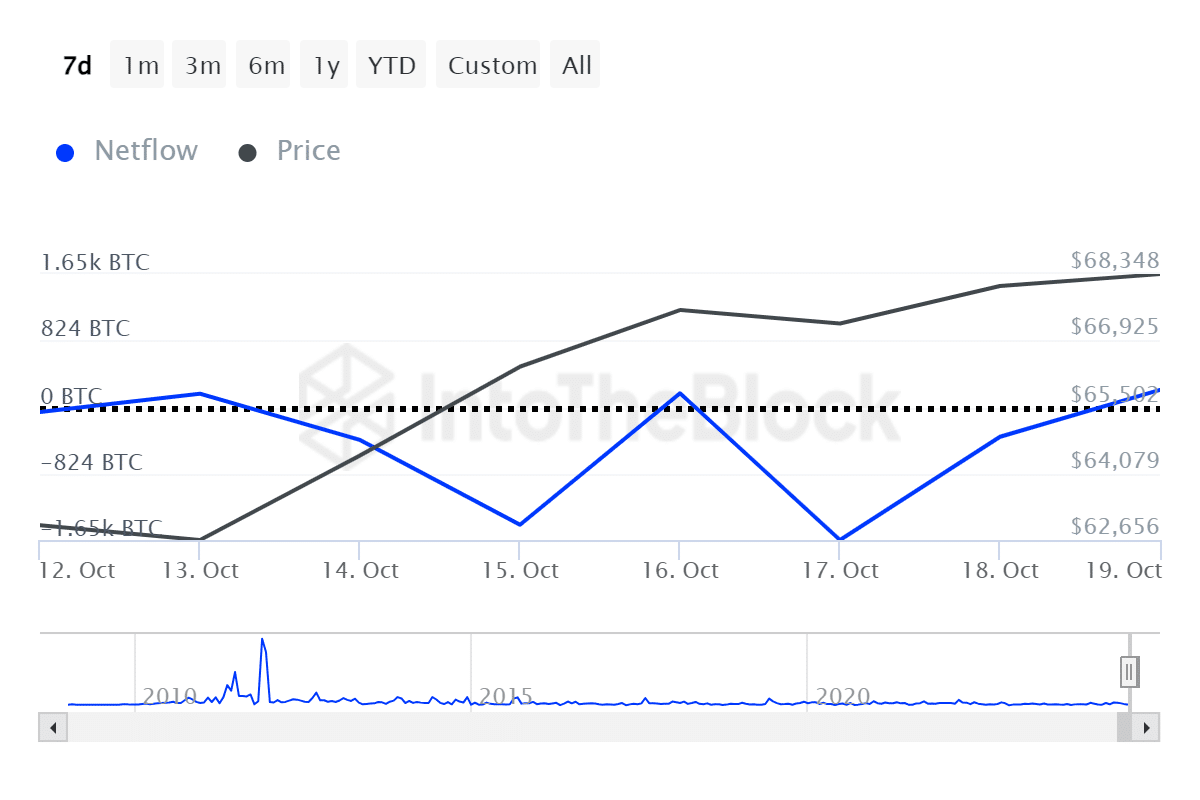

According to data provided by IntoTheBlock, the Bitcoin (BTC) whale net flow shifted from an outflow of 1,650 BTC on Oct. 17 to a net inflow of 211 BTC on Oct. 19. The momentum shows increased accumulation from large holders.

CryptoQuant CEO Ki Young Ju confirmed the intensified accumulation.

Per a crypto.news report, data provided by Young Ju shows that new whale addresses, with at least 1,000 BTC, held over 1.97 million coins yesterday—showing an 813% surge since the start of the year.

One of the key drivers behind Bitcoin’s bullish momentum is the increased investor interest in the U.S.-based spot BTC exchange-traded funds.

According to the report, these investment products saw an inflow of $2.1 billion last week—the total net inflows surpassed the $21 billion mark.

Moreover, data from ITB shows that the Bitcoin exchange net flows remained in the negative zone for the third consecutive day, recording a net outflow of over 2,300 BTC, worth $157 million, on Oct. 19.

Increasing exchange outflows usually hint at a lower selling pressure. However, short-term profit-taking would still be expected since the BTC price is close to its all-time high of $73,750.

Bitcoin has been consolidating between $68,000 and $68,600 over the past 24 hours. Its market cap is sitting at $1.35 trillion with a daily trading volume of $13.8 billion — down by 55%.

A declining trading volume could potentially bring lower price volatility for the leading asset.

[ad_2]

Source link