[ad_1]

Bitcoin could hit $74,000 before the U.S. election, according to Geoff Kendrick, Standard Chartered’s Head of Digital Assets Research.

Kendrick says that factors like a steeper U.S. Treasury yield curve, increased interest in spot Bitcoin ETFs, and a rising chance of Donald Trump winning the election are creating favorable conditions for Bitcoin.

Trump’s election odds are surging

According to the prediction platform Polymarket, Trump now has a 56.3% chance of victory, while Kamala Harris has only 41%.

If he wins, there’s a 70% chance that the Republican Party will control both the Senate and the House of Representatives.

Kendrick explained that this political setup could be a game changer for Bitcoin, which could benefit from more favorable policies under a Trump-led government.

Meanwhile, according to data from SoSoValue, spot Bitcoin ETFs saw their largest single-day inflow since June, pulling in $555.8 million on Monday. Out of 12, 10 saw net inflows, with none posting any net outflows.

There has also been increased activity around Bitcoin call options with an $80,000 strike price for December 27. Kendrick said that another 1,500 Bitcoin were added to the open interest of these $80,000 call options over the last week.

Short-term holders get a break

On top of that, Bitcoin’s recent break above $67,000 has already flipped some short-term holders from losses to profits.

This has pushed Bitcoin above the short-term holder realized price, meaning that many traders who were holding at a loss are now seeing gains.

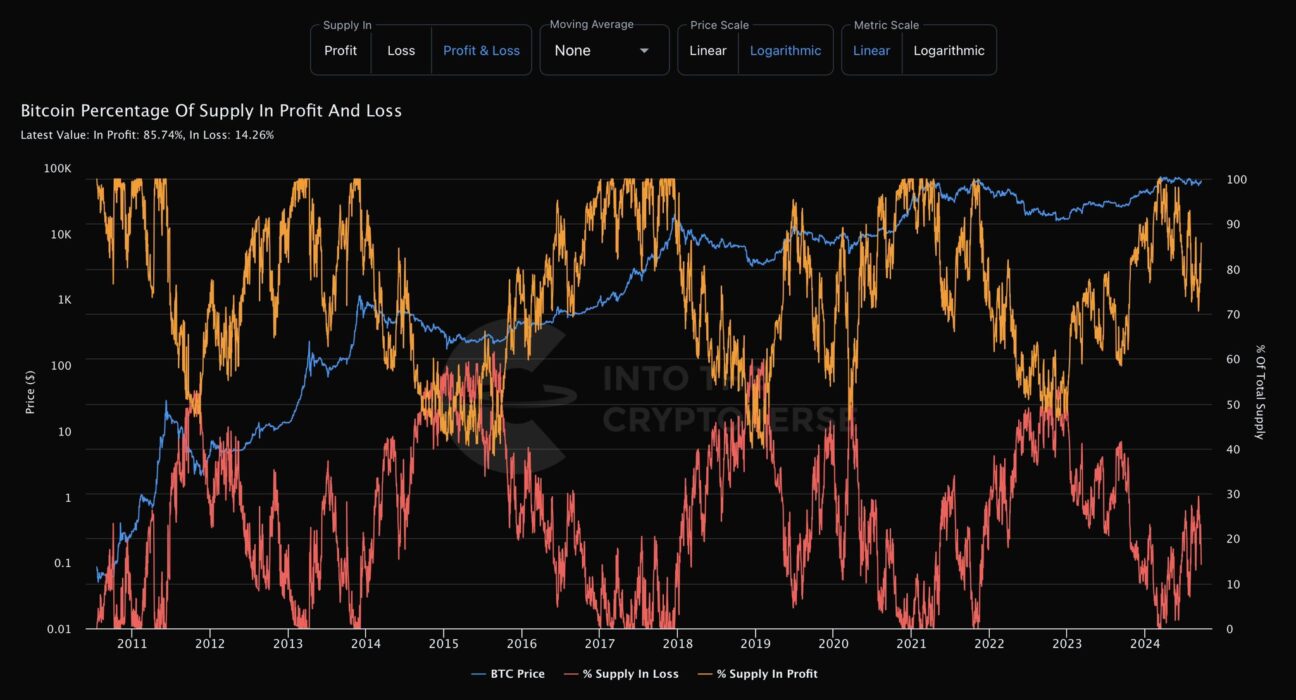

A chart from Into The Cryptoverse shows that when Bitcoin was at $66,870 on October 16, only 8.5% of investors were still holding at a loss. This means 91.5% of Bitcoin’s total supply is now in profit.

When most holders are in profit, it’s usually a sign that the market is getting overheated, and corrections could follow. Bitcoin’s price could see pullbacks over the coming days as traders start to book their profits.

Technically, Bitcoin is facing strong resistance at the $68,000 level. This is the same level that rejected Bitcoin’s price on July 29, leading to a 27% drop that bottomed out at $49,577.

Kendrick warns that bears will likely defend this price level again. If Bitcoin bulls fail to break this resistance, the price could correct downward, with long position liquidations dragging it down toward $61,000.

But if Bitcoin can push past $68,000 and close above this level, it could signal a sustained rally.

[ad_2]

Source link