[ad_1]

Key takeaways

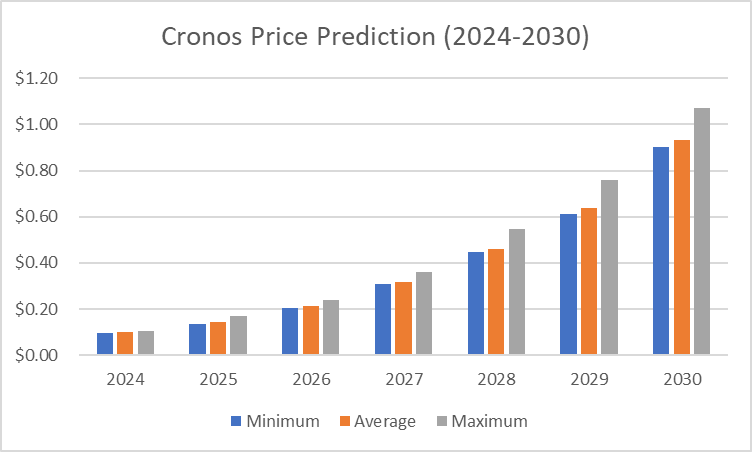

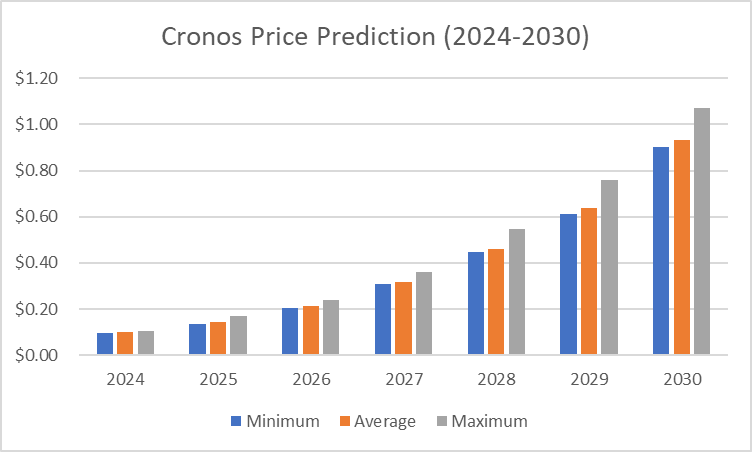

- The CRO price prediction shows it will reach a maximum level of $0.09202 with an average price of $0.1013

- By 2027, CRO could reach a maximum value of $0.3609, with an average trading price of $0.3167.

- Cronos is expected to reach a maximum level of $1.07 in 2030.

Cronos (CRO) is the native cryptocurrency token of the Crypto.com chain, a decentralized, open-source blockchain developed by the Crypto.com payment, trading, and financial services company. CRO aims to power the next generation of decentralized crypto assets and applications and enable real-time, low-cost transactions globally.

Cronos cross-bridge mainnet beta suggests a bright future for CRO. This feature aims to improve interoperability between significant blockchain ecosystems, potentially increasing CRO’s attractiveness to developers and users. CRO’s recent performance reflects robust in market sentiment and confidence. These factors combined present Cronos as a compelling investment opportunity within the dynamic cryptocurrency market.

Eminem’s involvement comes when Crypto.com has been actively expanding its visibility through various high-profile partnerships, such as with actor Matt Damon and major sports teams.

The blend of celebrity influence, such as Eminem’s endorsement, with significant tech developments like the Cronos cross-bridge, creates a unique market positioning that could lead to favorable outcomes in its pricing dynamics.

Overview

| Cryptocurrency | Cronos |

| Token | CRO |

| Price | $0.08503 |

| Market Cap | $2,259,473,238 |

| Trading Volume | $5,637,017 |

| Circulating Supply | 26,571,560,696 CRO |

| All-time High | $0.9698 Nov 24, 2021 |

| All-time Low | $0.01149 Dec 17, 2018 |

| 24-h High | $0.08525 |

| 24-h Low | $0.08332 |

Cronos Price Prediction: Technical Analysis

| Metric | Value |

| Price Prediction | $ 0.070469 (-16.24%) |

| Volatility | 3.92% |

| 50-Day SMA | $0.084065 |

| 14-Day RSI | 49.60 |

| Sentiment | Bearish |

| Fear & Greed Index | 50 (Neutral) |

| Green Days | 16/30 (53%) |

| 200-Day SMA | $0.10155 |

Cronos price analysis: Bearish momentum continues amid weak buying interest

Key takeaways

- Cronos (CRO) faces critical resistance at $0.081, limiting upward momentum.

- RSI at 41.57 suggests neutral to bearish market sentiment for CRO.

- Breaking the $0.081 resistance could lead CRO to test the $0.0857 level next.

Cronos technical analysis on 27th October reveals (CRO) is trading at $0.0736, marking a slight 0.41% rise over the last 24 hours. Despite this minor uptick, CRO remains heavily influenced by a persistent bearish sentiment, with its price action indicating a continued downtrend. Recent trading volumes have been subdued, pointing to a lack of strong buying support at current levels, which may hinder any potential recovery in the near term.

The overall market sentiment around CRO has been pessimistic, with the asset struggling to break free from its bearish trend. This extended period of declining prices has kept the asset below its crucial support and resistance levels, making it difficult for bulls to gain a foothold. With macroeconomic factors and general market uncertainty also playing a role, CRO’s outlook appears to be weak unless it manages to secure substantial upward momentum.

Daily chart analysis: CRO shows limited recovery potential as bearish pressure dominates

Analyzing the daily chart for Cronos, it’s evident that the token has been trading in a consistent downtrend. The price is positioned below key moving averages, such as the 20-day and 50-day Simple Moving Averages (SMAs), which are acting as strong resistance levels. The Bollinger Bands on the daily timeframe have been relatively narrow, suggesting low volatility and possibly signaling a significant move on the horizon. However, whether this move will break the bearish cycle remains uncertain, as indicators largely favor sellers.

The MACD (Moving Average Convergence Divergence) on the daily chart is mildly negative, with the MACD line positioned below the signal line. This configuration confirms a bearish bias, reinforcing the likelihood that CRO might continue to experience bearish pressure. Should the price action maintain this trajectory, CRO could soon test the support level around $0.07. Breaching this support could open up further downside risks, especially if broader market conditions do not improve. Conversely, any recovery attempts are likely to meet resistance near the moving averages, limiting the upward potential for CRO in the short term.

The RSI (Relative Strength Index) on the daily chart is currently at 34.66, showing that CRO is not yet in oversold territory but is moving closer to it. This might attract some short-term buyers looking to capitalize on a potential bounce. However, without significant buying volume, it is unlikely that these levels will trigger a meaningful reversal.

CRO 4-hour chart analysis: Short-term indicators signal possible relief rally

On the 4-hour chart, Cronos presents a mixed picture, with short-term indicators pointing towards a potential relief rally. The Stochastic RSI is currently at an overbought level of 88.75, suggesting that the recent minor recovery may face selling pressure soon. This overbought condition could lead to a brief retracement if sellers respond to the price movement. The 14-day RSI, however, reads 42.46, which is in the neutral zone.

The Commodity Channel Index (CCI), which measures the deviation of the asset’s price from its statistical average, is at -38.05 on the 4-hour chart. This negative reading aligns with the bearish sentiment but also points to the possibility of an incoming bounce if buying pressure builds. Historically, the CCI suggests that a shift in price direction could occur when it moves out of extreme levels. However, in the current market context, any such bounce may be short-lived unless CRO manages to break above key resistance levels around $0.0750.

The 4-hour MACD indicator offers a glimmer of hope for bulls, as the histogram has shown a slight reduction in bearish momentum, indicating that sellers may be losing strength in the short term. Although the MACD line remains below the signal line, any shift in momentum here could provide an opportunity for CRO to attempt a rally. However, it is essential to recognize that the broader market trend is still heavily bearish, and any short-term gains may face resistance.

What to expect from CRO price analysis

The outlook for Cronos remains cautious, with both daily and 4-hour charts suggesting continued bearish momentum despite some indications of a potential short-term rebound. The asset’s current levels are close to critical support at $0.07, which, if breached, could expose CRO to further declines, potentially testing multi-month lows. On the other hand, for CRO to see any sustained upward movement, it would need to break past resistance levels around $0.0750 and $0.0800, which seems challenging in the current market conditions.

Investors should closely watch the $0.081 and $0.085 resistance levels, as breaking above these thresholds could signal a stronger bullish trend for CRO. Conversely, failure to maintain current levels could lead to further downside pressure, with key support levels at $0.072 and below. For now, CRO appears to be in a consolidation phase, with potential upside if broader market conditions remain favorable.

Cronos Technical Indicators: Levels And Action

Daily Simple moving average (SMA)

| Period | Value | Action |

| SMA 3 | $ 0.086111 | SELL |

| SMA 5 | $ 0.086974 | SELL |

| SMA 10 | $ 0.086714 | SELL |

| SMA 21 | $ 0.08391 | BUY |

| SMA 50 | $ 0.084065 | BUY |

| SMA 100 | $ 0.087082 | SELL |

| SMA 200 | $ 0.10155 | SELL |

Daily exponential moving average (EMA)

| Period | Value | Action |

| EMA 3 | $ 0.084004 | BUY |

| EMA 5 | $ 0.084158 | BUY |

| EMA 10 | $ 0.085092 | BUY |

| EMA 21 | $ 0.086137 | SELL |

| EMA 50 | $ 0.089222 | SELL |

| EMA 100 | $ 0.095905 | SELL |

| EMA 200 | $ 0.100131 | SELL |

Is Cronos a good investment?

Investing in Cronos offers a strategic opportunity in decentralized finance (DeFi) and digital assets. As the native token of Crypto.com chain, Cronos supports DeFi, NFTs, and decentralized apps, benefiting from interoperability with ecosystems like Ethereum and Cosmos. Its energy efficiency, fast transactions, and low fees enhance its appeal. With a strong total value locked (TVL) and promising future growth projections, Cronos stands out as a compelling long-term investment in the blockchain space.

Will Cronos recover?

Cronos shows a recent decline with signs of stabilization and minor recovery, suggesting that future price of the token trading volume may recover.

Will Cronos reach $0.15

According to the long-term predictions, Cronos is projected to reach up to $0.15 by 2025.

Will Cronos reach $1

Yes, Cronos is projected to reach up to $1 by 2030 according to the long-term predictions.

Will Cronos reach $100?

It is doubtful that Cronos will reach $100 given that it would require an enormous market capitalization, which is currently unrealistic given the overall crypto market cap size.

Does Cronos have an excellent long-term future?

Cronos is showing stabilization and some recovery, which indicates that CRO may have a promising long-term future.

Recent news/opinion on Cronos

- Crypto.com launches its AI Agent SDK in beta, enabling Web3 and AI developers to use natural language commands for blockchain tasks. Compatible with platforms like Telegram and Discord

- Sentio now supports Cronos zkEVM and EVM, enabling developers to create custom blockchain indexers, query data, and access instant APIs. A developer workshop is coming soon!

CRO price prediction October 2024

For October, Cronos (CRO) is primed for notable growth. The minimum projected trading price is $0.08529, with an average of around $0.08712. CRO is expected to attain a peak price of $0.09202.

| Month | Potential Low | Potential Average | Potential High |

| October | $0.08529 | $0.08712 | $0.09202 |

CRO price prediction 2024

In Q4 2024, experts suggest Cronos will trade at a minimum price of $0.0978 and a maximum price of $0.1048. The average trading price is expected to be around $0.1013.

| Cronos Price Prediction | Potential Low | Potential Average | Potential High |

| Cronos Price Prediction 2024 | $0.0978 | $0.1013 | $0.1048 |

CRO price prediction 2025-2030

| Year | Minimum | Average | Maximum |

| 2025 | $0.1364 | $0.1415 | $0.1694 |

| 2026 | $0.2060 | $0.2117 | $0.2371 |

| 2027 | $0.3082 | $0.3167 | $0.3609 |

| 2028 | $0.4474 | $0.4601 | $0.5447 |

| 2029 | $0.6138 | $0.6369 | $0.7586 |

| 2030 | $0.9024 | $0.9343 | $1.07 |

Cronos price prediction 2025

The Cronos price prediction for 2025 suggests a minimum of $0.1364, a maximum level of $0.1694, and an average price of $0.1415.

CRO price prediction 2026

In 2026, the price of Cronos is predicted to reach a minimum of $0.2060. CRO can reach a maximum level of $0.2371 with an average trading price of $0.2117.

CRO price prediction 2027

The Cronos price prediction for 2027 suggests a minimum value of $0.3082, a maximum value of $0.3609 and an average trading price of $0.3167.

CRO price prediction 2028

As per findings, the CRO price could get the maximum possible and highest price level of $0.5447 with an average forecast price of $0.4601.

CRO price prediction 2029

In 2029, the price of Cronos is predicted to reach a minimum of $0.6138. CRO can reach a maximum price of $0.7586 with an average trading price of $0.6369.

Cronos CRO price prediction 2030

The price of CRO is predicted to reach a minimum of $0.9024 in 2030. It can further reach a maximum price of $1.07 with an average price of $0.9343.

Cryptopolitan’s Cronos CRO Price Prediction

According to our Cronos price forecast, the coin’s market price might reach a maximum value of $0.115 by the end of 2024. By 2026, investors can anticipate an average price of $0.18 and a maximum price of $0.20 provided the market is bullish.

Cronos market price prediction: Analysts’ CRO Price Forecast

| Firm | 2024 | 2025 |

| Gov.Capital | $0.216 | $0.486 |

| DigitalCoinPrice | $0.19 | $0.26 |

| CryptoPredictions | $0.2334 | $0.5643 |

Cronos historic price sentiment

- According to the earliest price data obtained from Coinmarketcap, CRO kicked off with a market price of $0.01977 on December 14, 2018. The price quickly rose to $0.03729, and in the following months, CRO traded within a range of $0.012 – $0.024.

- By March 12, 2019, CRO hit $0.07344 and continued to trend upwards over the next few days, reaching above the $0.1 mark on March 15. CRO lost momentum towards the end of 2019 and ended the year at $0.03358.

- In 2020, CRO was stable in the first few months, with minimal historical price movements and spikes. By the second half of 2020, CRO exceeded its highest market price in 2019 and crossed the $0.20 mark by August 21, 2020. CRO closed the year on a low and dropped to about $0.06.

- 2021 proved a good year for major cryptocurrencies such as BTC and ETH, as both touched new all-time highs. CRO was not left behind; it rode with the bullish crypto momentum by surpassing its highest point in 2020 and attaining its current ATH of $0.9698 on November 24. The upward surge in price experienced by the coin, especially in November, can be attributed to its listing on Coinbase Pro and Bitrue.

- At the start of 2022, CRO began with an opening price of $0.5575. The coin has lost about 24.67% of its value and is currently trading at $0.4409.

- Multiple reports about a possible security breach on the Crypto.com ecosystem surfaced on January 17, 2022. The platform acted accordingly by temporarily suspending withdrawals pending investigation.

- The price history of Cronos (formerly Crypto.com Coin) from 2023 to the present shows significant fluctuations.

- Starting in January 2023, the price of Cronos was relatively stable but began to steepen by late February, peaking around mid-March at approximately $0.80.

- This peak was followed by a sharp decline, during which the price dropped dramatically, settling back to lower levels by April 2023.

- Over the following months, the price stabilized somewhat but maintained a general downtrend. By mid-2023, it was trading at around $0.20 and continued to oscillate around this range, with slight ups and downs.

- Entering 2024, the price has shown a modest recovery but remains well below its early 2023 high, trading around $0.10 as of the latest data point.

- Entering 2024, CRO showed a modest recovery from late 2023 lows, rising from about $0.05 to around $0.10 by January.

- Significant rally (Mar 2024): CRO saw a sharp rise in early 2024, peaking near $0.18 in March, marking its highest point for the year.

- Steady decline (Apr-Jun 2024): After the March peak, the price steadily declined, falling to approximately $0.12 by June.

- Stabilization (Jul–Oct 2024): Throughout the summer, CRO hovered between $0.08 and $0.10, with the latest price point in October 2024 being around $0.081.

[ad_2]

Source link